The 6 best finance apps to help you manage your money

Hello #ThriftyThursday! Today I’ve written a round-up of my favourite personal finance apps and tools. I’m a bit of a geek when it comes to personal finance so I use a few digital apps and These tools will help you get in control of your spending, saving and help you have good money habits.

Hello #ThriftyThursday! Today I’ve written a round-up of my favourite personal finance apps and tools. I’m a bit of a geek when it comes to personal finance so I use a few digital apps and These tools will help you get in control of your spending, saving and help you have good money habits.

1 | YNAB (best finance app for budgeting & getting out of debt)

Website: https://www.youneedabudget.com/

You Need a Budget (YNAB) has transformed my relationship with money. I’ve written about it before and it’s the bee’s knees of budgeting software. It doesn’t just keep track of what you’ve spent and help make sure you avoid over-spending, it helps you plan and control your future spending.

You Need a Budget (YNAB) has transformed my relationship with money. I’ve written about it before and it’s the bee’s knees of budgeting software. It doesn’t just keep track of what you’ve spent and help make sure you avoid over-spending, it helps you plan and control your future spending.

It doesn’t just keep track of what you’ve spent and help make sure you avoid over-spending, it helps you plan and control your future spending.

Until I used YNAB I was always caught off guard by big annual (but completely predictable) expenses that I’d failed to set aside money for. Now I build those expenses into my monthly budget and set the money aside in an instant access savings account.

YNAB does cost around £40 ($50) a year, but there’s a 34 day free trial, and it’s saved me 10 times that amount in the two years I’ve been using it.

[label type=”primary”]Related: [/label] 6 simple steps to financial freedom on a single income

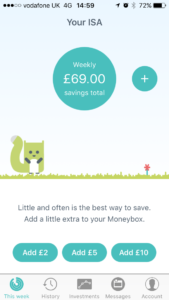

2 | Moneybox (best finance app for saving)

Website: https://www.moneyboxapp.com/

Before I discovered Moneybox last year I’d never had a stocks and shares ISA before. Now I’ve got one for my emergency fund and a Junior ISA for Elodie.

Before I discovered Moneybox last year I’d never had a stocks and shares ISA before. Now I’ve got one for my emergency fund and a Junior ISA for Elodie.

I save a set amount every week into my emergency fund and use the Moneybox round-up feature to put money away in Elodie’s account.

The app is linked to my main bank account and every time I spend it rounds-up the amount I’ve spent to the nearest pound so I can add that amount to her savings. For instance, if I spend £9.75 in a cafe, it will add 25p to the roundups.

A nifty way of building up savings without even noticing.

3 | Wave (best finance app for accounting and sending invoices)

Website: https://www.waveapps.com/

My accounting package of choice for managing my business finances and sending invoices. It links to my bank accounts and quickly and easily creates beautiful invoices that you send to clients as links.

There’s also a mobile app to keep track of invoices and to scan and another to scan and upload receipts.

The best thing about it? It’s entirely FREE.

4 | Google Sheets (BESt FINANCE APP for financial random calculations!)

Website: https://www.google.co.uk/sheets/about/

Despite all the apps and specialised tools, sometimes only a spreadsheet will do. I usually turn to a trusty Google sheet to calculate hypothetical budget scenarios, or to plan bespoke financial plans. I recently used on to create a debt and savings snowball plan.

5 | xe Currency (Best FINANCE APP for currency conversions, obviously!)

Website: http://www.xe.com/apps/

In this increasingly global economy we all live in I find I’m regularly having to quickly convert dollars and euros to ££s. I pay for quite a few of the tools I use for my business in dollars and most of the courses and the resources I use are priced in dollars too.

In this increasingly global economy we all live in I find I’m regularly having to quickly convert dollars and euros to ££s. I pay for quite a few of the tools I use for my business in dollars and most of the courses and the resources I use are priced in dollars too.

Having the XE Currency app on my phones means I can do a quick conversion, have a clear idea of how much something costs in good old British Sterling.

6 | Paypal (Best finance app for receiving online payments!)

Website: https://www.paypal.com/uk/webapps/mpp/mobile-apps

Is there anything quite as satisfying as getting a ‘You’ve received a payment’ alert from Paypal when someone buys one of your online products?

Is there anything quite as satisfying as getting a ‘You’ve received a payment’ alert from Paypal when someone buys one of your online products?

This is by far the best reason for having the Paypal app on your phone. Of course, you can also keep track of your balance and send payments with it, but that’s very dull in comparison!

What are you favourite financial apps and tools? Are there financial apps your can’t live with out?