How to manage your money: 6 simple steps to financial freedom on a single income

It’s #ThriftyThursday! Once or twice a month I’ll be sharing my top money management tips, covering all things in the realm of budgeting and money saving and to help you manage your money on a single income.

This week, I’m sharing the six steps that are essential if you want to get in control of your personal finances and achieve financial freedom.

Living on a single income is flippin’ tough and if that income is also an irregular self-employed income it’s even tougher. But it is doable.

The key is learning how to manage your money better. Frankly, this isn’t only essential if you’re considering self-employment, it’s a basic life skill everyone should learn.

Why don’t they teach personal finance at school? Forget algebra, understanding how credit cards work is far more useful. But I digress.

Getting in control of how I manage my money was the single most important thing I did when I decided to quit my job. I used to have no idea what I spent on food a month, I never saved money and I wracked up debts on credit cards willy-nilly.

[label type=”primary”]Related:[/label] 18 advantages of self-employment for single mums

But when you’re faced with waving goodbye to a regular income, taking these six steps so you can take money off your list of things keeping you awake at night is essential.

I strongly recommend you work through these steps in order because each step makes the next step easier or more achievable.

I’ll admit, this plan is still a work in progress for me. I’m somewhere between step 4 and step 5. And I’m only managing to save and pay off debts because I’ve rented my house out and am living with my mum.

The cash-cushion I had when I quit my job is severely depleted so once I’ve saved an emergency fund and paid off my debts that’ll be my next goal.

However, I’m very glad I’ve learned these vital money management skills because there’s no way I’d have survived nearly two years of self-employment if I hadn’t.

So let’s dive in.

Step 1: CREATE a budget & stick to it

The single biggest thing that gave me the confidence to quit my corporate job was having a thorough, warts and all, understanding of my living expenses.

Knowing how much you need to earn to pay for all your basic needs is crucial. I’m talking about the essentials that keep a roof over your head – your mortgage or rent, your basic utilities like gas and electricity, council tax, TV licence, phone and broadband. Plus food, petrol and childcare expenses if you need it.

I tried all kinds of budgeting techniques – spreadsheets, apps that tracked your spending. But none of it helped me stay on top of what I was spending.

Then I discovered YNAB.

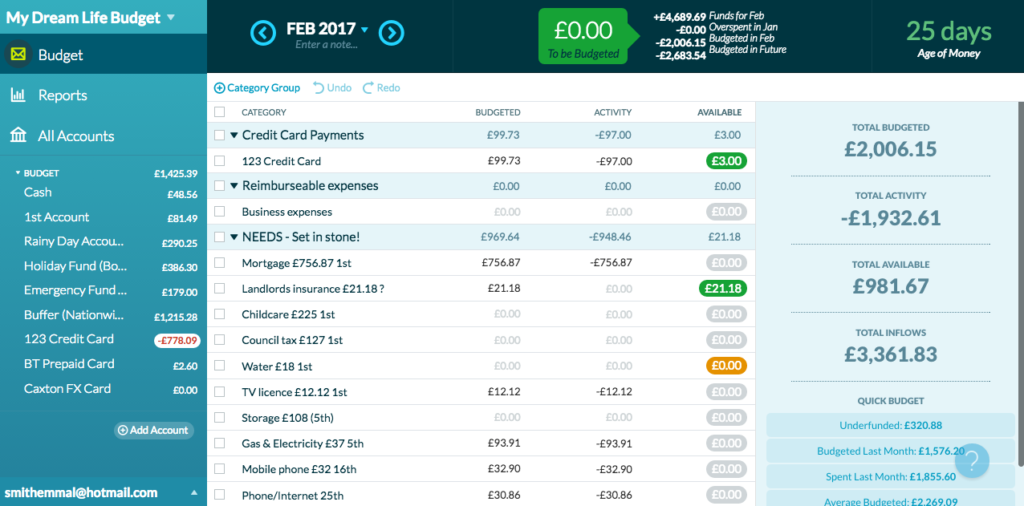

YNAB or You Need A Budget, is an online budgeting tool like no other. I know quite a few freelancers and entrepreneurs who swear by it.It doesn’t just record what you’ve spent, it helps you plan and control your future spending.

[label type=”primary”]Related[/label] My February 2017 Income Report

It’s brilliant for managing an irregular income, and for making sure you’ve set aside money for big annual expenses so they don’t take you by surprise.

How it works is like a fancy digital version of the old-fashioned envelope method of budgeting. You set up budget categories and assign a budgeted amount to each of category. The budgeting gurus at YNAB call this ‘giving every dollar a job’.

Then as you spend you record your spending in YNAB and can see at a glance how you’re doing against your budget. If you overspend in one category you know you have to reduce what you’ve spent in another category.

YNAB does cost around £40 ($50) a year, but there’s a 34 day free trial, and it’s saved me 10 times that amount in the two years I’ve been using it.

Step 2: Shop around to cut back Your outgoings

When you’re figured out what you currently spend, it’s time to see where you can save a few bob on your bills by shopping around.

> Could you reduce your energy bills by switching providers?

> Are you getting the best deal on your broadband?

> Is your mobile phone provider robbing you blind?

> Could you shop around for cheaper car insurance?

> Maybe you could get a better rate on your mortgage or switch your credit debts to a 0% interest deal?

My first port of call for all things personal finance related is the Money Saving Expert website – run by an old uni friend of mine, Martin Lewis.

I reckon I’ve saved thousands on by always checking their advice first before applying for a mortgage/credit card/new mobile/broadband or car insurance.

Step 3: Live more frugally

The fact is when you’re starting out on your self-employment journey you probably won’t earn very much. So the reality is you’re going to have to forgo a few of life’s luxuries for a while.

With your budget as a guide, take a look at where you can cut back.

> Could you restrict yourself to eating out only twice a month, or make coffee at home instead of buying it at Costa?

> Perhaps you can find somewhere cheaper to get your hair done or DIY your nails for a while.

> Could you start doing yoga at home instead of paying for expensive classes?

Also, take a look at what you spend on essential like food and petrol:

> Shop at a budget supermarket. This can save you a hefty amount every week. I love Waitrose, but shopping at Asda helped me keep my weekly shop to an aver of £35 a week for the two of us. Use MySupermarket to do a price comparison of the major supermarkets so you can see where you’ll get the best deal.

> Buy own brand products where you can. I used to turn my nose up at doing this, but there really is little difference between Asda’s own brand pesto, for instance, and the more expensive premium brand.

> Shop online. You easily keeping track of what you’re spending, making sure you stay within budget and you’re less likely to be tempted by special offers.

> Save on fuel. Use petrolprices.com to see where your cheapest local petrol station is. Our local Asda petrol station is sometimes 7p a litre cheaper than other places.

[label type=”primary”]Related:[/label] How to save money on food (the quick & simple way)

Step 4: Save a £1000 emergency fund

All your money saving good intentions can be wasted if you’re hit with an unexpected bill that wipes out your bank account or sends you into debt, so it’s a good idea to have at least £1000 tucked away somewhere for rainy days.

No matter how small amount you can start saving make it part of your monthly budget. Even if it’s just £5 to start with. it will quickly build up.

The key is to PUT IT SOMEWHERE WHERE YOU WON’T TOUCH IT. I’ve started emergency funds many times, but I put the money into a savings account linked to my current account. Big mistake. It made it far too easy for me to raid the account every time I was short of cash elsewhere.

Now I automatically transfer my tax credits and child benefit into a stocks and shares ISA that’s much harder for me to withdraw money from.

I’ve never had a stocks and shares ISA because I always found them bamboozlingly complicated. But recently I discovered Moneybox. It’s an app that makes stocks and shares ISAs really simple for the likes of you and me who have no clue about the stock market or which managed funds to pick.

You pick the level of risk you’re comfortable with then either save a set amount or use their fun ‘round-up’ feature. This involves linking the app to your current account and every time you spend money the app rounds up the amount to the nearest £ and deposits the extra amount into your Moneybox account.

If you don’t have much extra income at the moment it’s an easy way to save a few pounds a week without even noticing.

Step 5: Pay off your debts

Next, you want to focus on getting rid of any debts. Now you’ve got an emergency fund hopefully you’ll be able to avoid accumulating any more debt. But what can you do about the debt you’ve got?

Start a debt plan, and prioritise becoming debt free ahead of any other savings.

I’m using Dave Ramsay’s snowball method. I’ve budgeted £150 a month to pay off my two credit cards. I’m paying the minimum payment on the card with the highest balance, and throwing the rest at the one with a lower balance.

That means the first card will be paid off quickly, and then I can put everything towards paying off the second card.

Whenever I have any extra money I’ll make paying off the cards a priority, once I’ve saved my emergency fund, and I hope to be out of debt within six months

Step 6: Build up a cash cushion

Start saving a six-month cash cushion now as soon as you can. But I think it’s wise to pay your debts off first if you have any. Once you’re debt free, you’re better able to focus on putting an end to living from paycheque to paycheque.

Take the household budget amount you worked out above, multiply it by six and make that your savings goal.

Having a savings cushion, or buffer, to fall back on gives you much-needed peace of mind. If you have a month where you don’t earn very much you can top it up from your buffer fund.

If your current income doesn’t allow you to save, think about how else could you get the money. Could you:

> do some freelance work while the kids sleep?

> borrow against your mortgage?

> live with a friend or relative for a while?

> sell stuff you don’t need anymore – clothes, furniture, baby stuff, toys?

Once you start earning you’re likely to only dip into this money to top up your income. My initial six-month buffer lasted me a year.

If you only complete Step 1 of this money management process you’ll be way ahead of most people. Being in control of my budget boosted my confidence about surviving once I was self-employed. I realised I didn’t need nearly as much as I thought to cover my basic living expenses.

One of the biggest reasons people give for not taking the leap into self-employment is concerns about money. But if you start with these six steps I guarantee you’ll quickly feel more confident about your financial situation.

It’s not just about how to manage your money, it’s about having the freedom to live the life your deserve.